Margin Rates as Low as 6.8%

- Extensive selections of Exchange-Traded Funds (ETFs)

- Easy-to-analyze ETF charts and data breakdown

What is Margin Trading?

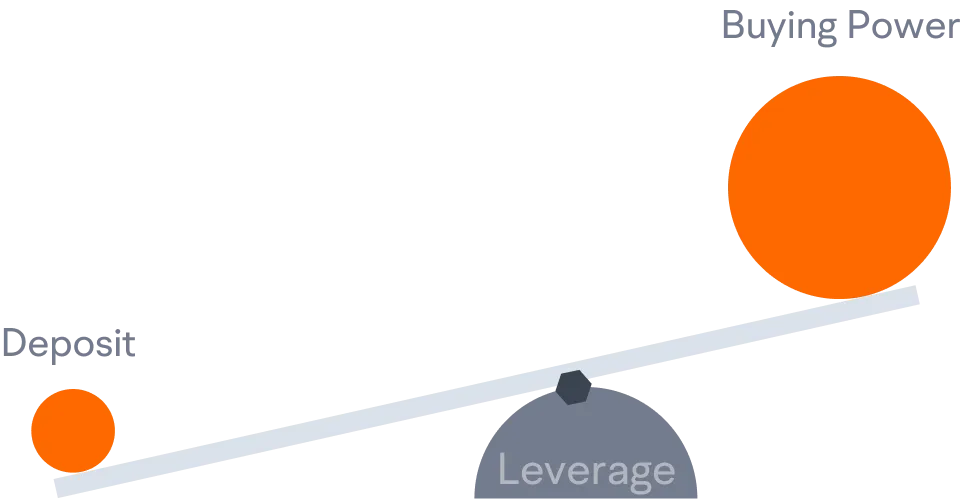

Trading securities on margin* is most commonly understood as borrowing money from a broker to buy a stock.When buying on margin, the investor uses the marginable securities or cash in their brokerage account as collateral to secure the loan. The collateralized loan comes with an interest rate that will be calculated periodically and charged. While margin trading increases your purchasing power, it’s important to understand that with the potential for higher returns, there’s also more risk.

How Margin Trading works?

Margin trading allows investors to borrow funds from a broker to purchase securities, using the marginable cash and securities already held in their account as collateral. Brokerage customers who sign a margin agreement can generally borrow up to 50% of the purchase price of new marginable investments.

Low Margin Rates* ,

$0 Commission

Pay $0 in commission and get margin interest rates*as low as 6.8% on TP24 Limited. See pricing for details

Understanding the Risks of Margin Trading

Margin trading should only be pursued by experienced traders with high-risk tolerance . Even experienced trader may have losses far higher than their original investment.

Before you start margin borrowing, you should know the risks:

- You must regularly monitor your account to help manage market risk from the fluctuations of your chosen securities.

- Leveraging investments increases risk, as you must pay the loan regardless of the underlying securities’ values.

- Margin loan interest rates may increase at any time, which would increase your costs.

- There are account value requirements that must be met, and your securities may be liquidated.

Trade Wherever

You Go

Experience the power of TP24 Limited's powerful suite of tools

on desktop or mobile.